Building Energy Efficiency Incentives

May 28, 2014

For many, the barriers to energy improvement seem too high to overcome. Even though energy improvements often pay for themselves over time, high upfront costs can be a burden. Commercial buildings also tend to change hands fairly often, which presents a significant discouragement to the kinds of long-term investments that energy improvements require. Clearly, there is an ongoing need for building energy efficiency incentives.

For many, the barriers to energy improvement seem too high to overcome. Even though energy improvements often pay for themselves over time, high upfront costs can be a burden. Commercial buildings also tend to change hands fairly often, which presents a significant discouragement to the kinds of long-term investments that energy improvements require. Clearly, there is an ongoing need for building energy efficiency incentives.

Enter property-assessed clean energy (PACE) financing- a new way to encourage and incentivize energy improvements. PACE financing amortizes repayment over 20 years, which means that in many cases utility savings exceed the monthly payments.

PACE finances 100% of energy efficiency, water efficiency, and renewable energy projects. Paid back over time through the existing property tax bill as a voluntary property tax assessment, PACE makes energy improvements feasible for many property owners who thought upfront costs prohibited them from making improvements.

PACE loans are also tied to the property, rather than the individual owner, and may be transferred upon sale or refinancing. This makes PACE financing ideal for owners who are not sure if they will retain their property for the entire life of the loan.

PACE financing makes energy improvements feasible because of low interest rates and long-term financing with little or no upfront investment. While new communities and states are continuously being added to the PACE program, PACE is not available everywhere yet.

Click here to access an interactive map of PACE legislation and activity in the U.S. to see if PACE financing is available in your area.

You can also click here to see if PACE is available in your state.

You may be interested in these other posts:

- PACE Renewable Energy Financing Programs

- Where are PACE Energy Programs Available?

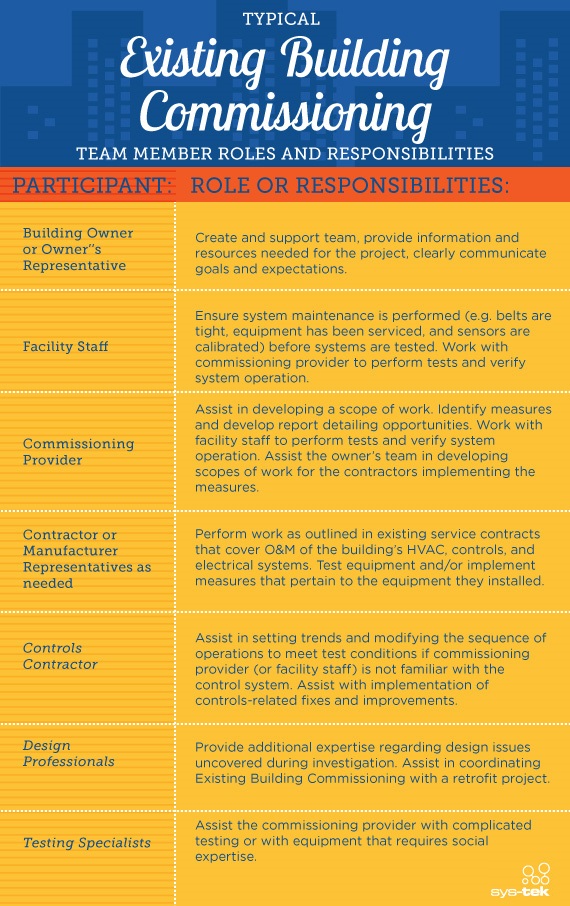

- 6 signs your building needs existing building commissioning